OPERATING ENVIRONMENT

The operating environment was stable during Q3 2023 following policy intervention measures instituted by the Government to tackle price and exchange rate volatility. The measures resulted in stable market conditions though the gap between the official and parallel rates is now increasing. The Bank Policy rate stood at 150% as of September 2023 while the official exchange rate, which was at USD1:ZWL5 769 at the beginning of the quarter closing at USD1:ZWL5 467.

According to the Total Consumption Poverty Line (TCPL), local currency year-on-year inflation peaked in June 2023 when it registered 394.8% but has since receded to 249.7% in September 2023. Third quarter inflation was 139.1% from a quarterly inflation movement of 208.4% in Q2 2023. According to the July 2023 Monthly Economic Brief issued by the Reserve Bank of Zimbabwe, 82.4% of total money supply is in foreign currency indicating the significance of foreign currency transactions in the economy.

The Zimbabwe Stock Exchange’s (ZSE) performance in the third quarter of 2023 was negative as the ZSE All Share Index retreated by 26%. The softening of the market was more pronounced in July 2023 (-33.06%) and August 2023 (-9.05%) with a slight rebound in September 2023 (+1.2%) as the market started responding to the easing liquidity conditions towards the end of Q3 2023. The VFEX All Share index returned -2.2% during the quarter in real terms and was down to 24.8% on a year-to-date basis. The negative returns were underpinned by net selling pressure from foreign investors, but this appears to be slowing down.

The Botswana economy continues to be stable despite the BWP weakening against the USD. An improved diamond mine proceeds agreement between De Beers Group and the Botswana Government is expected to underpin more positive growth in the future.

In Mozambique, the economy has maintained signs of growth as evidenced by a stable exchange rate and declining inflation.

INFLATION ADJUSTED REPORTING

In October 2019 the Public Accountants and Auditors Board concluded that the conditions for applying International Accounting Standard (IAS) 29 – Financial Reporting in Hyperinflation Economies had been met in Zimbabwe. The historical cost financial results have been restated to consider changes in the purchasing power of the local currency during the year. From February 2023, the Zimbabwe National Statistics Agency (ZimStat) ceased the publication of the ZWL Consumer Price Indices (CPIs) and replaced them with the weighted average consumer price index also known as blended indices in line with the Statutory Instrument 27 of 2023 which requires the inflation rate to be calculated as the weighted average of the ZWL and USD inflation rates. This created challenges for financial reporting purposes as the weighted average consumer price index does not comply with IAS 29 which requires the use of a Consumer Price Index (CPI) of the hyperinflationary currency (ZWL) as a basis of restatement. FMHL has applied IAS 29 for the nine-months ended 30 September 2023 with the CPI estimated using the TCPL movement. The inflation adjusted financial results therefore represent the main financial statements with historical cost financials provided as supplementary information:

OPERATIONS REVIEW

Insurance contract revenue

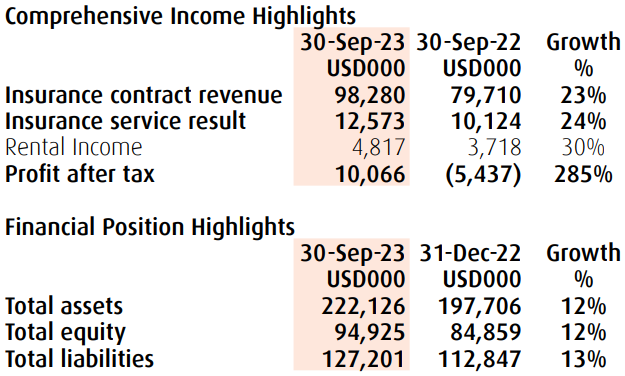

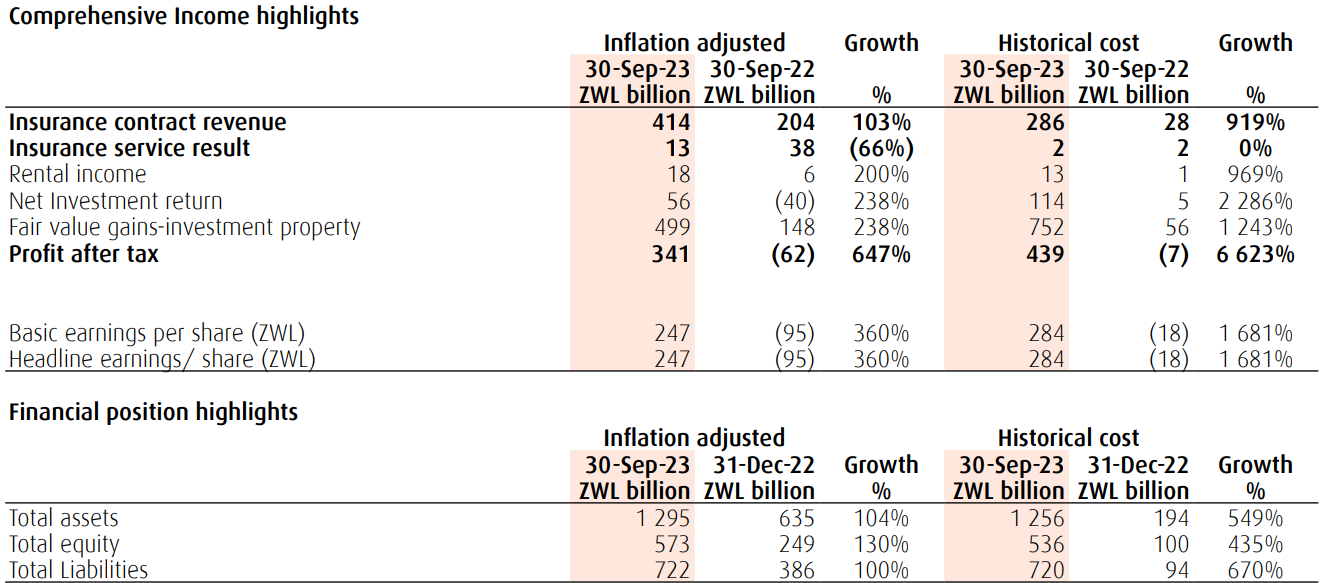

Insurance contract revenue (“ICR”) for the period amounted to ZWL413.6 billion in inflation adjusted terms which increased by 103% compared to the same period in the prior year (ZWL286.3 billion in historical terms representing growth of 919% on prior year). The year-on-year growth in the ICR was driven by the continued revaluation of insurance policy values to match inflation and exchange rate movements to ensure adequate cover for clients as well as improve product relevance. Additionally, clients have continued migrating to USD denominated policies for value preservation in case the insured event occurs. Total USD premiums stood at $70.2 million for the Group constituting 71% of total insurance revenue from 62% in the prior year.

Insurance service result

The insurance service result declined by 66% to $13.1 billion compared to the prior year. The decline was due to the impact of continuous ZWL depreciation on USD business with USD premiums being translated at the beginning of the cover period and the USD claims emerging at later stages. In USD terms there was positive growth in the insurance service result.

Rental income

Rental income for the period ended 30 September 2023 grew by 200% to ZWL18.2 billion in inflation adjusted terms and by 969% to ZWL13 billion in historical cost terms. This growth was driven by various factors including adjustments on ZWL rentals to align to the market rates and a higher proportion of USD denominated leases, with USD leases constituting 76% of the total rental income for nine months ended 30 September 2023. The occupancy levels stood at 87.82% from 87.49% in prior year, whilst the average rental/square metre increased to USD4.78 from USD3.48 in prior year.

Profit for the period

The business generated a profit for the period ended 30 September 2023 amounting to ZWL341 billion in inflation adjusted terms representing a growth of 647% compared to the previous year. In historical cost terms, the profit for the period amounted to ZWL439.3 billion representing a growth of 6,623% from prior year performance.

Total assets and equity

Total assets grew by 104% to ZWL1.3 trillion from ZWL635.6 billion in December 2022 in inflation adjusted terms (in historical costs terms the total assets stood at ZWL1.25 trillion representing a growth of 549% from 31 December 2022). The growth was mainly underpinned by fair value gains on the Group’s investment property and cash and bank balances, which translated to the positive growth in the total equity balance.

USD Supplementary Information